#The public company accounting oversight board how to

In late 2002, the initial PCAOB board members-including this author-began to discuss how to turn the statutory blueprint into a working inspection program. It provides that information received by the PCAOB in connection with an inspection is confidential and that criticisms of, or potential defects in, firm quality control systems are not to be made public unless the firm fails to address those deficiencies to the board’s satisfaction within one year. The law does, however, put some limits on inspection reporting.

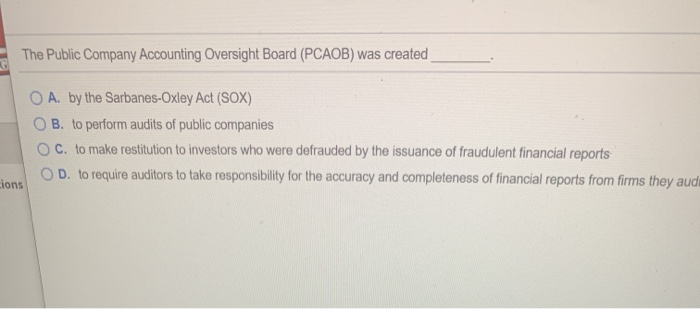

It requires a public report on the results of each inspection, but says little about how inspections should be performed or about the content of inspection reports. SOX directs the PCAOB to annually inspect audit firms with more than 100 public company clients and to inspect other firms that regularly audit public companies at least once every three years. The cornerstone of the SOX oversight regime is the PCAOB, and the cornerstone of PCAOB oversight is its inspections program. These events severely shook confidence in the audited financial information upon which capital markets depend. bankruptcy, following disclosure of its history of financial reporting fraud. In 2001, Enron announced that its financial statements could no longer be relied on in mid-2002, WorldCom filed what was then the largest-ever U.S. Beginning in the late 1990s, revelations of accounting frauds and accompanying investor losses frequently dominated the headlines. SOX created the PCAOB in the wake of a series of financial reporting failures. The Birth of the PCAOB and its Inspections Program

0 kommentar(er)

0 kommentar(er)